Advantages

Optimal conditions for trading indices

1

Financial instruments

Our tools will make your trading much more convenient when analyzing the markets.

2

Reliable support

The team of professionals at NexGen Finance always responds promptly to your inquiries and finds solutions.

3

Leverage

Increase your profit through margin trading, even with small initial investments.

4

Order execution

Fast order execution will pleasantly surprise you with its speed and open up opportunities for scalping.

What are indices?

Indices evaluate the price performance of a group of stocks on the stock exchange, such as the FTSE 100, which tracks the top 100 companies on the London Stock Exchange. Trading indices allows you to open just one position and gain exposure to an entire economy or sector.

Novice investors in financial markets often choose to trade indices using a fund that tracks the index or a basket of stocks instead of buying and selling individual company stocks. CFDs allow you to speculate on changes in index prices without owning the actual underlying assets. Index trading provides access to a highly liquid market, and due to longer trading hours compared to most other markets, you can capture potential opportunities for an extended period of time.

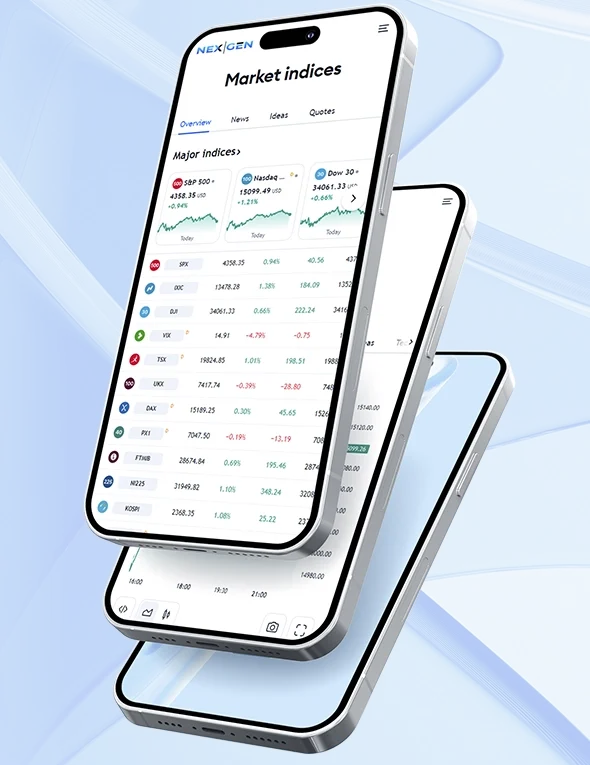

NASDAQ 100 (US Tech 100)

The market value of this index is based on the top 100 non-financial companies in the United States.

DJIA (Wall Street)

This index determines the value of the top 30 blue-chip stocks on the American market.

DAX (Germany 40)

The performance of this index is dependent on the 40 largest companies traded on the Frankfurt Stock Exchange.

Welcome to NexGen Finance

Join us right now and start trading. Registration with NexGen Finance is quick, and within just a few minutes, you’ll be ready to get started.